Dealer Perspectives – John Hoffman, Ag Used Equipment Manager, Atlantic & Southern Equipment

Brand color is up for grabs as farmers search beyond their preferred brand of ag equipment seeking availability, value, new technology and improved innovation.

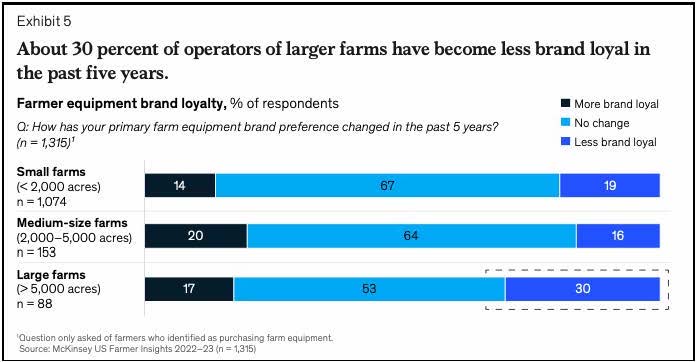

Nearly 30 percent of large farmers say that brand loyalty is less of a priority when selecting farm equipment than it was five years ago, according to a May 2022 McKinsey survey cited in the September 2022 article, “Voice of the US farmer in 2022: Innovating through uncertainty.”

Brand loyalty has declined, according to John Hoffmann, Used Equipment Manager at Atlantic & Southern Equipment, a seven-store Massey Ferguson, Fendt, AGCO and Caterpillar dealer headquartered in Atlanta.

“Last year was really tough on new equipment. It almost caught us by surprise, and as the year went on we kept ordering…but it kept backing up. Then towards the beginning of this year, we did get a lot of new equipment and as it turns out, a lot of the other brands did not.”

Brand became less important to buyers as availability decreased, Hoffmann said. About 90 percent of the Fendt tractor sales at the Atlanta dealership were to non-Agco brand customers because the tractors were available.

Availability is not the only factor that buyers consider when purchasing a new piece of equipment. There are a few factors that would keep farmers from switching brands: value, repair, service, technician specialists, parts availability, and new product knowledge and innovation.

During this time of change, dealers can look for new ways to engage and support their customers through renewed partnerships. Dealers are still crucial in establishing and building loyalty to the brands of equipment they represent as farmers are more likely to be loyal to dealers who play a strategic partner role.

Learn More about IronGuides